Redhawk Fund

Redhawk Fund Team Fall 2023

Seattle University’s Redhawk Fund was founded in October 2009 with the goal to provide students with an opportunity to actively manage a portfolio using real money. The Fund started with $250,000 from the university’s endowment and has grown to over $1,120,000 since. The Redhawk Fund is a platform for Albers students to participate in equity research, portfolio management, and professional presentations. Thus preparing them for success in school as well as their careers.

Our Mission

The Redhawk Fund’s main purpose is to grow the university endowment and to provide a learning opportunity to its members. We are focused on the art of business valuation and socially responsible investing while maximizing portfolio’s return and managing risk through proper diversification.

Faculty and Financial Advisory Board

The Redhawk Fund’s operations are overseen by our faculty advisor, Cathy Cao, as well as by members of the Department of Finance Advisory Board. We also have the guidance of our Student Advisory Board which is comprised of experienced Albers students. We regularly communicate our activities and progress with our faculty advisor. The faculty advisor along with the Board ensure that the management team adheres to the mission and policies of the Redhawk charter. The faculty advisor also routinely evaluates the portfolio management team’s performance.

Student Portfolio Managers

Student Portfolio Managers are responsible for maintaining a balanced and well-diversified portfolio. They provide guidance and direction to research analysts and make decisions related to asset allocation and Fund operations. Portfolio Managers also facilitate communication with the faculty advisor and Board, and ensure the timely execution of new trades. We have between 3 and 5 analysts in any given term.

Redhawk Fund Analysts

We have a team of 5-20 research analysts in any given term. The analyst's report to specific portfolio managers and are responsible for proposing potential investment positions to the team. Analysts provide information on such variables as market conditions, economic and political climate etc. Once an analyst performs a valuation and presents their recommendation to the team, they must receive a majority vote from the team to proceed with the trade.

Current Position

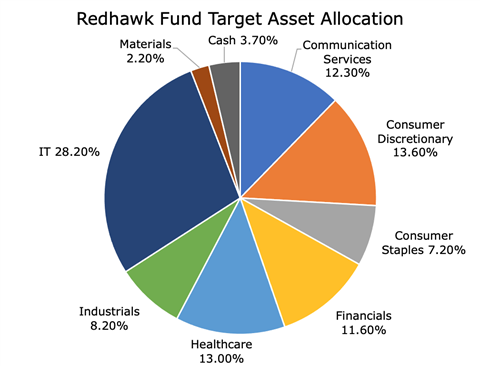

The Redhawk Fund’s market value as of September 30th, 2021 is over $1,120,000. Our current target allocation is:

Investment Philosophy

The Redhawk Fund’s goal is capital appreciation using the S&P 500 Fossil Fuel Free Reserves Index as the benchmark. The objective for the fund is to generate a rate of return greater than the benchmark. The portfolio will undergo a critical review as necessary by the Fund advisory board if there are extended periods of underperformance.

Risk Tolerance

The Redhawk Fund is a well-diversified portfolio, largely comprised of equities from large-cap US companies. It is the duty of the investment management team to minimize the amount of risk that is being employed in the portfolio through proper diversification.

Connect with us via LinkedIn and check out our videos on Youtube!