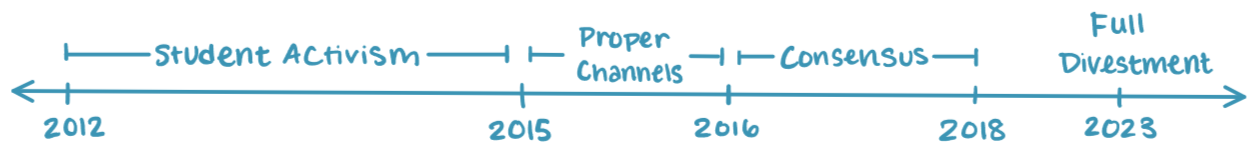

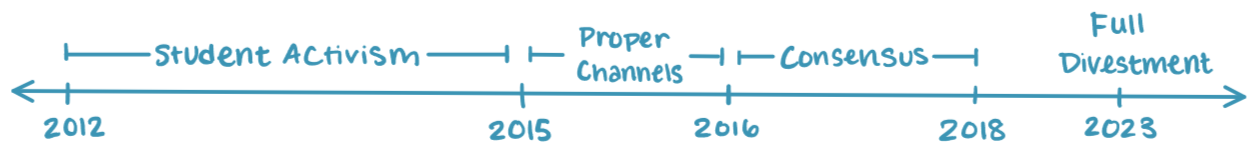

In 2018, Seattle University's (SU) Board of trustees voted to divest from fossil fuels with goals to, "by June 30, 2023, fully divest the marketable portion of the endowment from any investments in companies owning fossil fuel reserves,” and “to achieve a 50 percent reduction by December 31, 2020.” In March 2020, the 50% reduction was reached, nine months ahead of schedule. In June 30, 2023, SU fully divested from fossil fuels.

Learn more about the SRI Working Group

The purpose of this Divestment Case Study is to share SU's experience with divesture, inspire others, and educate on the importance of fossil fuel divestment.

On this page, you will find:

What is Divestment, ESG and SRI?

Divestment is simply is the opposite of an investment. It is the process of getting rid of stocks, bonds, or investment funds which can serve financial, ethical, or political objectives.

Environmental, social, and governance (ESG) criteria are the three key factors used to judge the sustainability and ethics of an investment.

Socially responsible investing (SRI) describes investments that promote positive social or environmental change. This can include investments in companies that are free from fossil fuel usage, give their employees living wages, etc.

SU's Divestment Timeline

For a detailed timeline depicting all divestment events at SU, see Detailed Divestment Timeline

-1920x745.png)